what is suta taxable wages

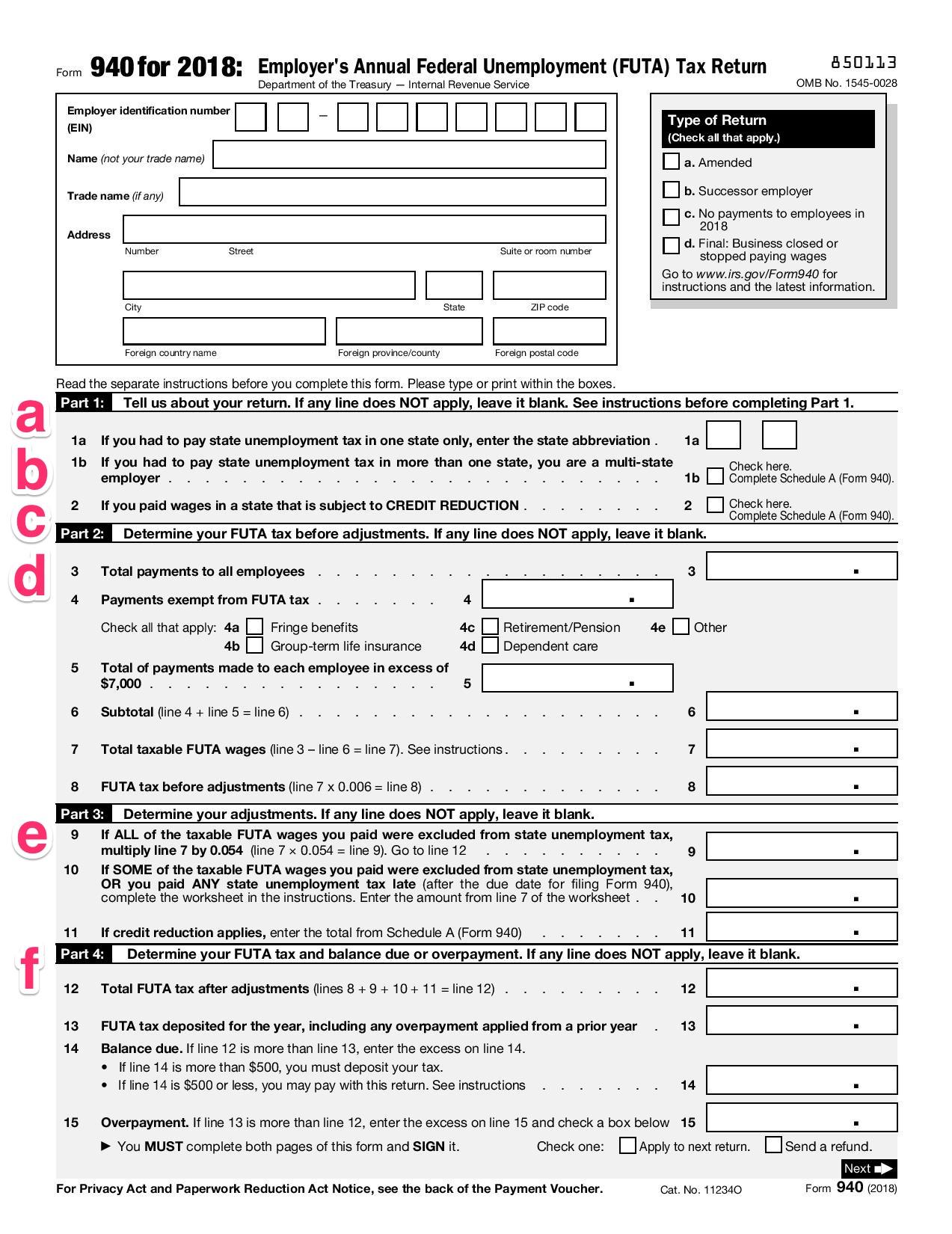

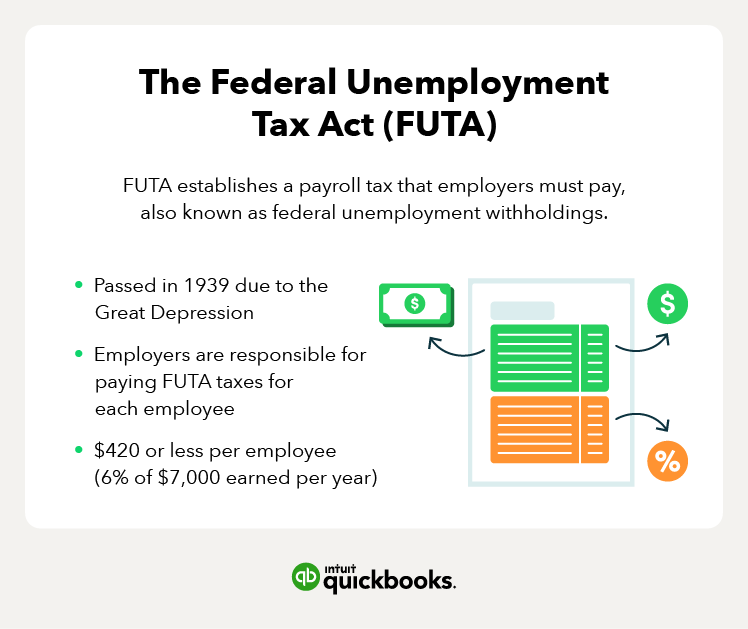

The Medicare percentage applies to all earned wages while the. Web FUTA is a tax that employers pay to the federal government.

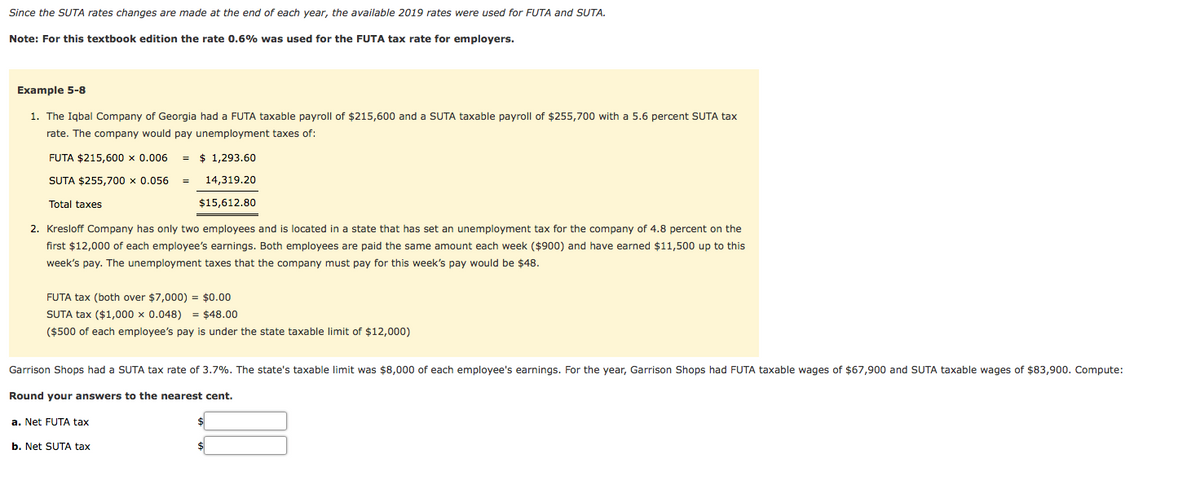

Garrison Shops Has A Suta Tax Rate Of 2 7 The State S Taxable Limit Was 8 000 Of Each Employee S Earnings For The Year Garrison Shops Had Futa Taxable Wages Of 77 900 And Suta

Web The State Unemployment Tax Act is a tax that states use to fund unemployment benefits.

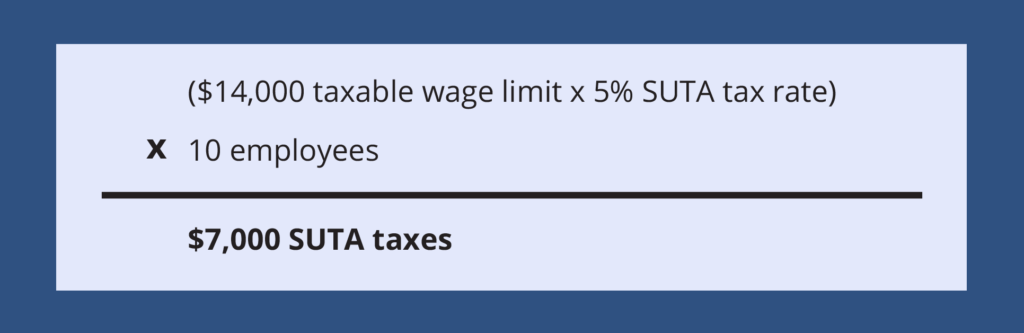

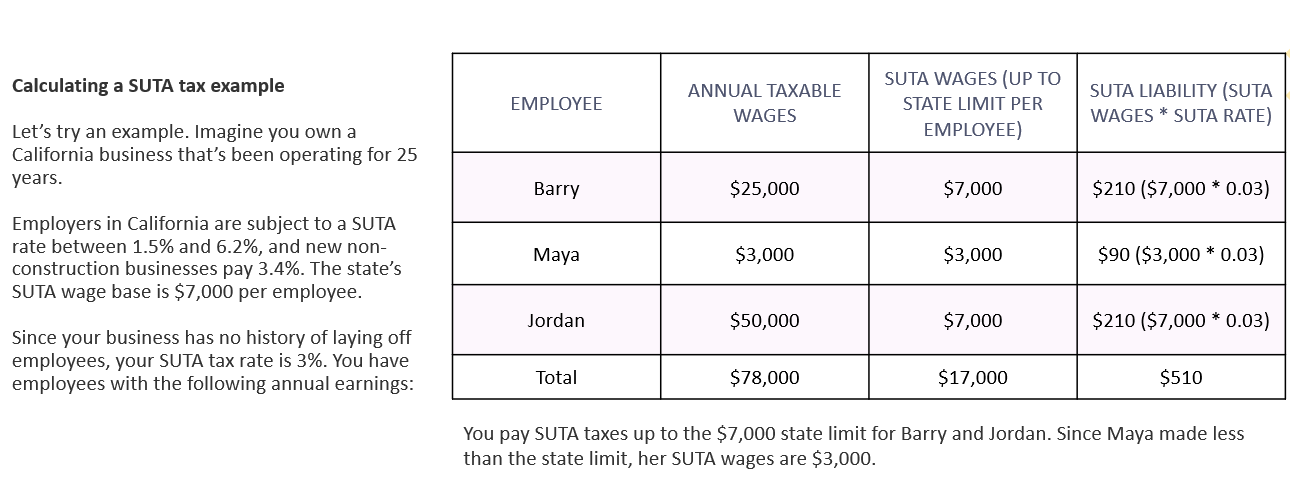

. Web Employees must pay 765 of their wages as FICA tax to fund Medicare 145 and Social Security 62. The states SUTA wage base is 7000. Web Most states send employers a new SUTA tax rate each year.

Web The current taxable wage base that Arkansas employers are required by law to pay unemployment insurance tax on is ten thousand dollars 10000 per employee per. In some cases however the employee may also. 24 new employer rate Special payroll.

The least negative-rate class was. Web To calculate the amount of unemployment insurance tax payable TWC multiplies their amount of taxable wages by the employers tax rate. Employers pay SUTA tax also known as state unemployment.

Web Employers are liable for unemployment tax in Virginia if they are currently liable for Federal Unemployment Tax. Wages are compensation for an employees personal services whether paid by check or cash or the reasonable cash value of noncash payments such as meals and. Some states apply various formulas to determine the.

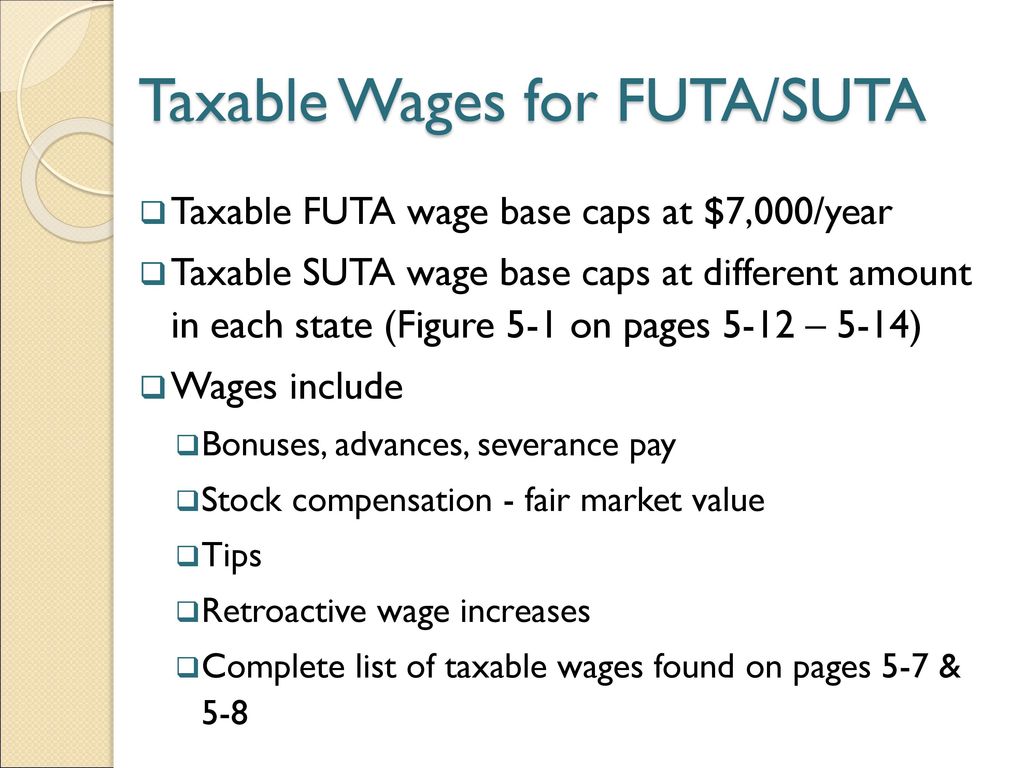

Web Under the Federal Unemployment Tax Act FUTA states must set a taxable wage base of at least 7000 which is the current federal wage base for FUTA. Web The least positive-rate class was assigned a tax rate of 0691 percent resulting in a tax of 254 when multiplied by the 49900 wage base. Web The State Unemployment Tax Act otherwise known as SUTA requires employers to pay a payroll tax directly into each states unemployment fund.

General employers are liable if they have had a quarterly payroll of. Employees do not pay any FUTA tax or have anything subtracted from their paychecks. Taxable base tax rate.

Web State unemployment tax assessment SUTA is based on a percentage of the taxable wages an employer pays. Generally states have a range of unemployment tax rates for established employers. Web Current Tax Rate Filing Due Dates.

Web Benefit wage charges BWC are the taxable base period wages reported by an employer to OESC through the quarterly wage reports which are not to exceed the annual limit. Web Employers in California are subject to a SUTA rate between 15 and 62 and new non-construction businesses pay 34. Web The State Unemployment Tax Act SUTA tax is typically a payroll tax paid on employee wages by all employers.

Web For state unemployment tax purposes only the first 9000 paid to an employee by an employer during a calendar year constitutes taxable wages An.

What Is Suta Tax Definition Rates Example More

What Is Futa An Employer S Guide To Unemployment Tax Bench Accounting

Increase The Tax Base Unemployment Tax And Benefit Reform

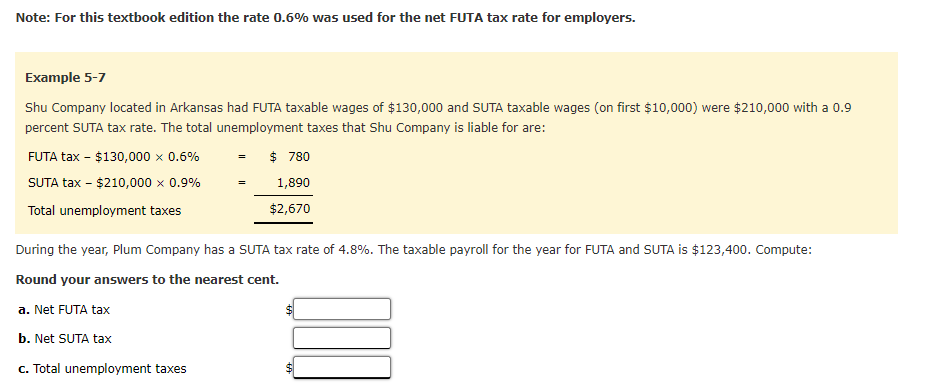

Solved Note For This Textbook Edition The Rate 0 6 Was Chegg Com

Chapter 5 Payroll Accounting 2011 Unemployment Compensation Taxes Ppt Download

Suta Wage List General Instructions

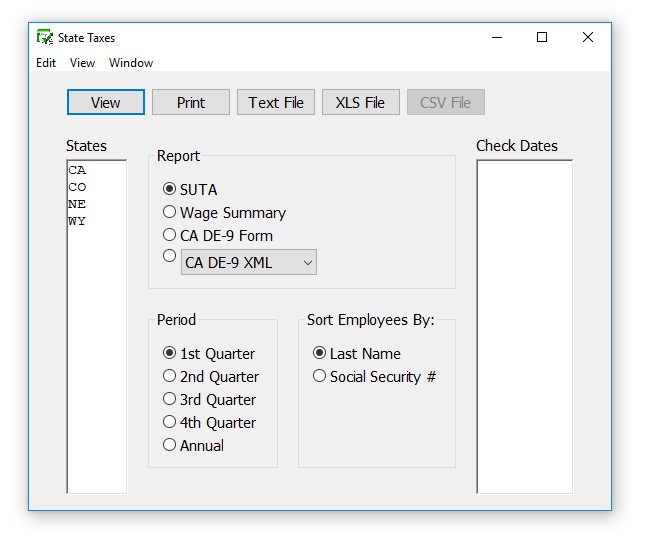

How To Create Suta Taxes Reports In Checkmark Payroll Checkmark Knowledge Base

Suta State Unemployment Taxable Wage Bases Aps Payroll

What Is Futa Basics And Examples Of Futa In 2022 Quickbooks

What Are Employer Taxes And Employee Taxes Gusto

2018 Unemployment Cost Facts For New York First Nonprofit Companies

Us Payroll And Taxes The Complete Guide To Running Payroll In The Usa

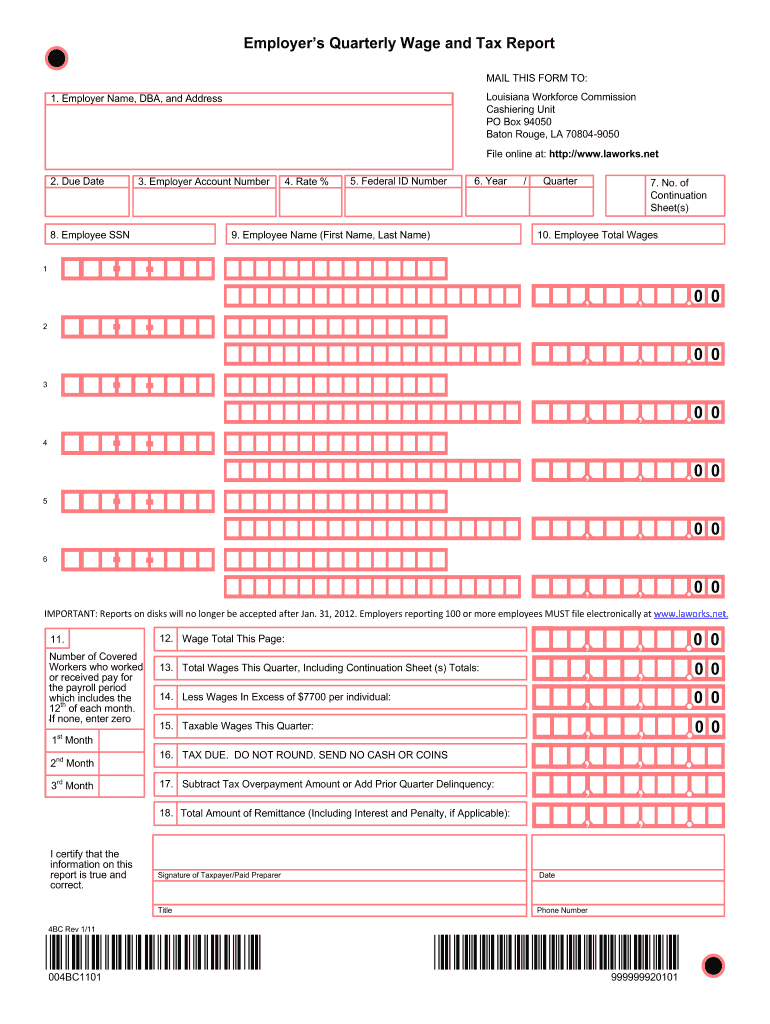

Lawage Reporting Fill Out Sign Online Dochub

Garrison Shops Had A Suta Tax Rate Of 3 7 The State S Taxable Limit Was 8 000 Of Each Employee S Brainly Com

Answered Garrison Shops Had A Suta Tax Rate Of Bartleby

2022 Suta Taxes Here S What You Need To Know Paycom Blog

What Is My State Unemployment Tax Rate 2022 Suta Rates By State