how to pay indiana state taxes quarterly

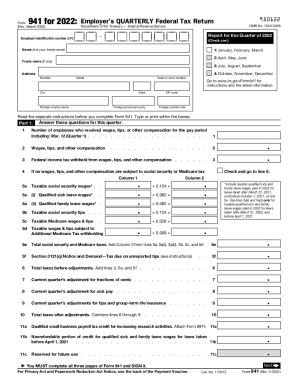

These regular tax payments are meant to cover Medicare Social Security and your income tax. Withholding and tax credit will not be less than.

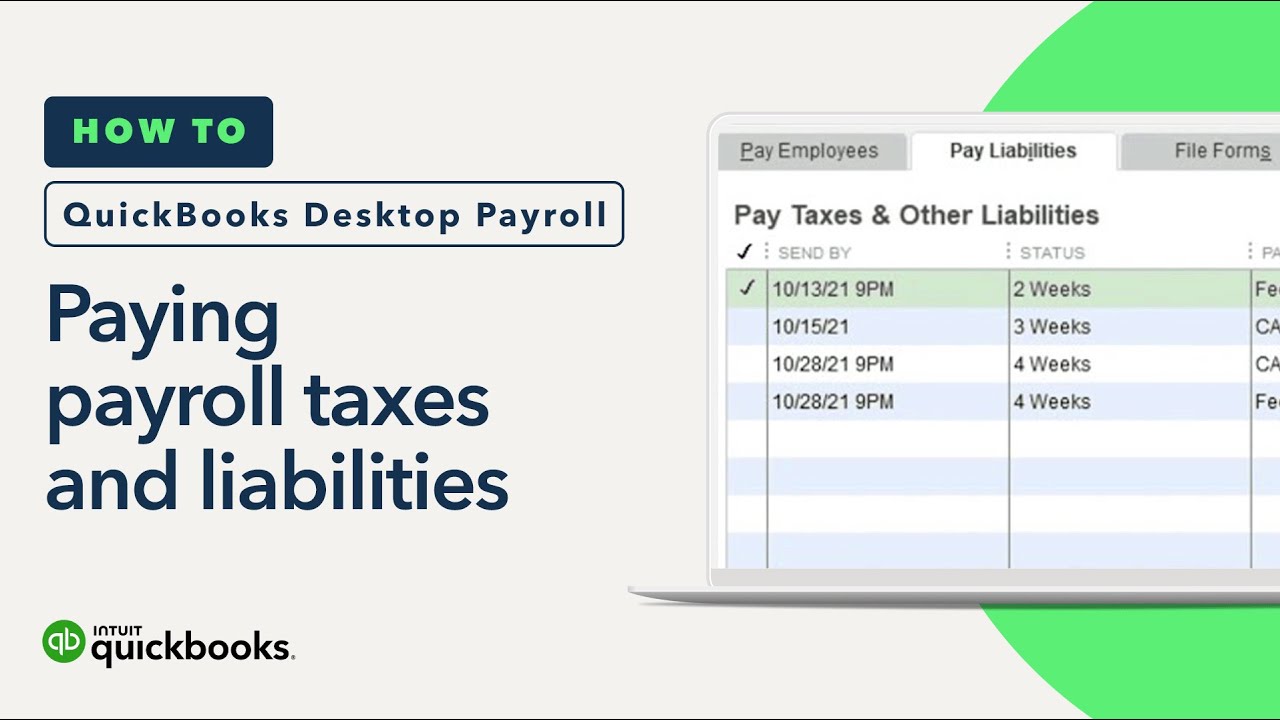

E File And E Pay State Forms And Taxes In Quickbooks Desktop Payroll Enhanced

Some states also require estimated quarterly taxes.

. 100 of the tax shown in the 2021 federal tax return as long as it covers all 12 months. File my taxes as an Indiana resident while I am in the military but my spouse is not an Indiana resident. However some counties within Indiana have an additional tax rate making the combined tax rate ranging from 373 percent to 613 percent.

If this is not valid refer only to the 90 rule. Use form ES-40 to pay Indiana state estimated quarterly taxes if applicable. As a reminder Heard cannot submit estimated tax for you and you are responsible for paying in a timely manner.

You can check specific county rates listed by the Department of Revenue. Based On Circumstances You May Already Qualify For Tax Relief. One to the IRS and one to your state.

The Indiana income tax rate is set to 323 percent. Tally Up Your Income. Have more time to file my taxes and I think I will owe the Department.

We last updated the Estimated Tax Payment Voucher in January 2022 so this is the latest version of Form ES-40 fully updated for tax year 2021. Under non-bill payments click your payment method of choice. The income tax and the self-employment tax.

Put together all of your Form 1099-NECs to add up your total nonemployee compensation. If you dont receive 1099s or if you. Lines J K and L If you are paying only the amount of estimated Indiana income tax due enter the amount from line I on line 1 State Tax Due at the top of the form.

Any employees will also need to pay state income tax. Be sure to denote that you are making an individual income tax payment. 90 of the quarterly estimated tax for the year 2022.

Heres a checklist and basic steps to pay quarterly taxes in 2022. This means you may need to make two estimated tax payments each quarter. Take the renters deduction.

Line I This is your estimated tax installment payment. Find Indiana tax forms. Claim a gambling loss on my Indiana return.

Estimated payments may also be made online through Indianas INTIME website. Follow the instructions to make a payment. Ad Provide Tax Relief To Individuals and Families Through Convenient Referrals.

SBAgovs Business Licenses and Permits Search Tool allows you to get a listing of federal state and local permits licenses and registrations youll need to run a business. Enter this amount on line 4 Estimated Tax Installment Payment at the top of the form. Pay my tax bill in installments.

If youre self-employed you need to pay federal estimated quarterly taxes for the income you make. Your tax projection exceeds 1000 after removing withholding and tax credits during tax return filing. Bank or credit card.

2 days agoHeres an overview of the process. Then the self-employment tax clocks in at 153. QuickBooks Self-Employed calculates federal estimated quarterly taxes.

Indiana Small Business Development Center. If you dont have a bill or dont know the amount due you can get assistance by calling the Indiana Department of Revenue at 317-232-2165. So you should familiarize yourself with how those taxes break down.

There are several ways you can pay your Indiana state taxes. Income tax follows the same income tax rates as salaried workers pay. Page Last Reviewed or Updated.

How To Pay Indiana State Taxes. Your browser appears to have cookies disabled. Cookies are required to use this site.

If you need more help with taxes. Know when I will receive my tax refund. Department of Administration - Procurement Division.

Solved Indiana Withholding Setup In Quickbooks Payroll

Quarterly Tax Calculator Calculate Estimated Taxes

Helpful Sales Tax Steps For Amazon Fba Sellers Amazon Fba Business Sales Tax Tax Return

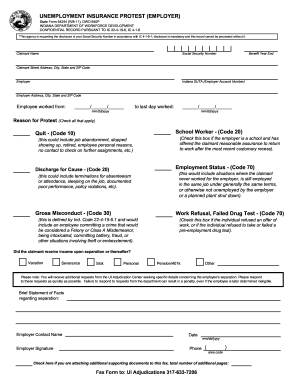

Indiana Quarterly Wage And Employment Report Fill Online Printable Fillable Blank Pdffiller

Quarterly Tax Calculator Calculate Estimated Taxes

Quarterly Tax Calculator Calculate Estimated Taxes

Indiana Quarterly Wage And Employment Report Fill Online Printable Fillable Blank Pdffiller

Self Employed Taxpayers How To Avoid A Large Irs Bill Ils

2021 Tax Aide Evansville Vanderburgh Public Library

Indiana Quarterly Wage And Employment Report Fill Online Printable Fillable Blank Pdffiller

E File And E Pay State Forms And Taxes In Quickbooks Desktop Payroll Enhanced

Indiana Quarterly Wage And Employment Report Fill Online Printable Fillable Blank Pdffiller

Quarterly Tax Calculator Calculate Estimated Taxes

.png)